To stay in touch, you can find us here: Gabrielle's Twitter and Shan’s Twitter

MSFT Earnings - Continued Decel, No Clear Signs of Stability

All you need to know: MSFT reported a mixed result with revenue miss and underwhelming profitability. Azure continues to decelerate albeit beat buy-side expectations by a tight margin. Azure has been the company's growth driver and the main stock driver. Current headwinds include post-covid normalization and macro-related spending optimization. Despite a dismal quarter, the stock price was revived from -a 5% selloff to flat, driven by the bulls who believe in the “soft landing” story.

Let’s dive into the numbers:

Total revenue coming in at $240mm or 7% cc growth, below consensus.

Azure growth is better than feared but still a disaster: Q3 FY22 49% >Q4 FY22 46%> Q1 FY23 42% > Q2 FY23 38%. Azure growth has been decelerating 4 quarters in a row, and the pace of deceleration has been increasing. While Azure‘s 38% constant currency growth came in at 1-2 pt ahead of buy-side estimates, management expects further deceleration ahead. Per CFO Amy Hood, “Microsoft guides CC growth to decelerate 4-5 points from the “mid-30s” December exit rate,” implying ~30-31% Y/Y CC growth, ~2-3 points below consensus expectations. While MSFT is a key beneficiary given its industry-leading AI capabilities driven by its unique partnership with OpenAI, it is still too small to be meaningful in the short term. Key highlights is that the number of Azure Arc customers doubled to 12,000 on a YoY basis.

PBP Strength supported by E5 license and strong security offering: PBP sales grew by 13% and continued to show strength. Office Commercial grew better than expected and is driven by two things: 1) continued ARPU expansion as demand for E5 and security products remains solid. 2) Strong resonance from O365 and Teams. We think this could imply an ongoing platform consolidation and continued pressure to single-point security products. It would be interesting to see how it competes with CRWD, S and OKTA.

MPC deceleration and return back to pre-pandemic: MPC revenue decreased by 16%, primarily driven by a slowdown in PC demand. Management noted the execution issues revolved around finding the right discounting for customers, ultimately leading to a 34% decrease in Device sales.

Implication: This is the 3rd quarter MSFT came in light on guidance, and we think the company has not yet reached an inflection point. Overall market sentiment has overwhelmed single stock logic in the past few weeks’ rally - therefore, there’s strong interest behind the ‘soft landing” narrative. But a reality check with the Azure result leads us to believe that caution should be prudently called until things stabilize.

(source: management presentation, wall street research)

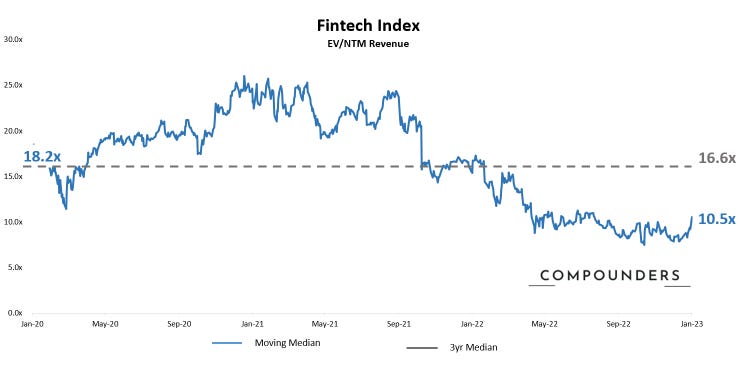

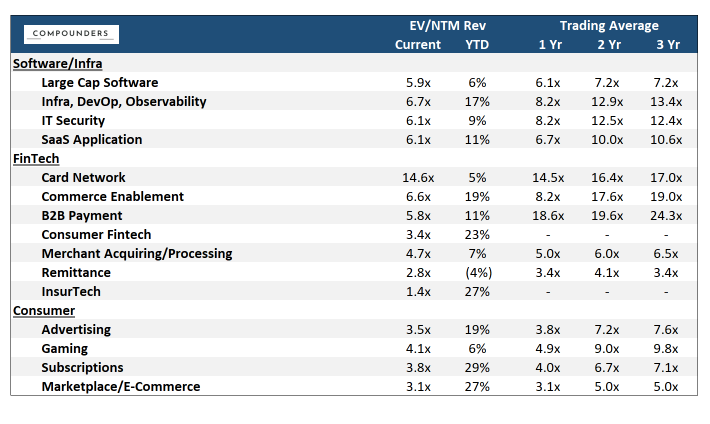

Chart of the Week in the Public Market:

Strong market rally at the beginning of the earnings cycle as Soft Landing narrative has dominated the short-term movements.

Major rebound in the Fintech sector - index inflected from 8.5x to 10.5x. Looking at the specific sectors, the previously most depressed space, such as InsurTech, Consumer Enablement, and Consumer Fintech, went up the most. Consumer Fintech is up 23% YTD with Insurtech up 27%.

Overall index remained roughly stable from 2.9x to 3x - Gaming continues to lead up the space with 4.1x multiple where Subscriptions have caught up a lot to now also close to ~4x.

(Market data as of 1/27/2022, source: Bloomberg, CapIQ. See index composition at the bottom)

Chart of the Week in Private Market

(Deal data as of 1/30/2022, source: Pitchbook. Defined as - Series B+ global growth stage deals)

Slight rebound from last week’s low - trailing at $6.2B of growth dollars deployed and announced. Some of the largest deals in the past few weeks include $120M for Boston Metal, $80M SetPoint Medical, $60M QuickNode, etc.

Sources: Software Index: over 200+ public companies / Fintech Index: V, MA, PYPL, SQ, BILL, ADYEN, SHOP, LSPD / Consumer Index: ABNB, BMBL, CHWY, CVNA, DASH, DHER, DKNG, DUOL, ETSY, FB, FTCH, GDRX, GOOGL, MTCH, NFLX, OPEN, PINS, POSH, PTON, ROKU, SFIX, SNAP, SPOT, UBER, W. Please feel free to ping us for further detailed breakdown