Compounders 1.9.22

Chart of the Week in the Public Market

(market data as of 01/07/2022, source: Bloomberg, CapIQ)

Commentary:

Rarely do we kick off a year with large-cap, small-cap, and bond selling off at the same time. Nasdaq fell by over 8% in 5 days, S&P fell by 2%. Bond price pushes 10-year TSY to 1.769%, reaching a peak since 2020. Rate concerns cloud all asset classes and we are still in the process of price discovery and finding the new equilibrium of terminal yield. In other words, the road ahead will be bumpy and will be like this for longer than we would like it to be.

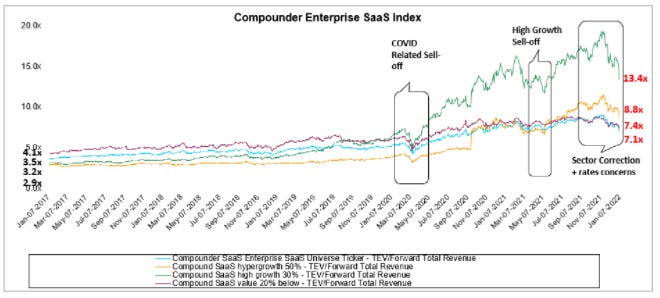

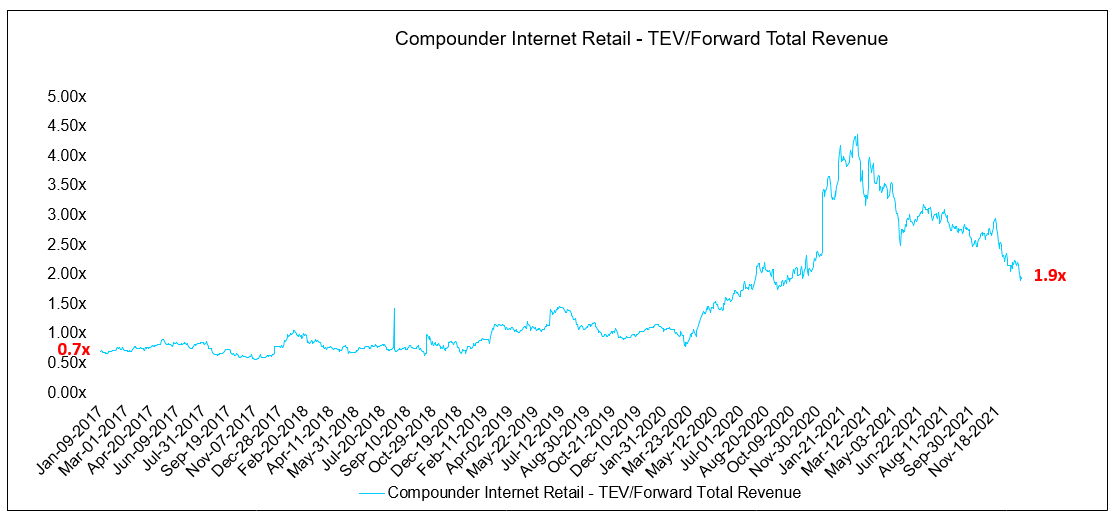

Be ready, this is going to be a tough year for high-growth sectors, especially SaaS. From a macro standpoint, the biggest takeaway from Fed minutes this week is that our hawkish Fed is ready to scale back economic stimulus. The bond market has priced in tapering in March (almost for sure) and balance sheet run-off. This is bad news as a strong dollar hurts EMEA revenue which accounts for ~20-40% revenue for growth tech names. Rising interest rates could alleviate rising inflation but doing it too early could kill Economic growth. The first chart tells us that SaaS names are now a pure yield play instead of business fundamentals. But there are more reasons beyond macro to be concerned. Here is a quick comb through:

The price dump of high-growth software began in November 2021 when hyper-growth software got hurt the most. It was a combination of macro concerns, investors took profit, WFH magic began to fade and a broader sector valuation adjustment. For the past 1-2 years, multiples have outgrown top-line growth. Many application software has pull-forward revenue to accelerate near-term growth, so a sector correction was due. Software fundamentals have also seen some slow down especially in fintech and bellwethers: ADBE, CRM, AMZN, PYPL start to miss their quarters since mid-2021. On the contrary, Infrastructure software and semiconductors are holding up strong. Current SaaS multiples are close to where we were in May 2021. High growth software comps (30%+ growth) is still elevated with further room to go down.

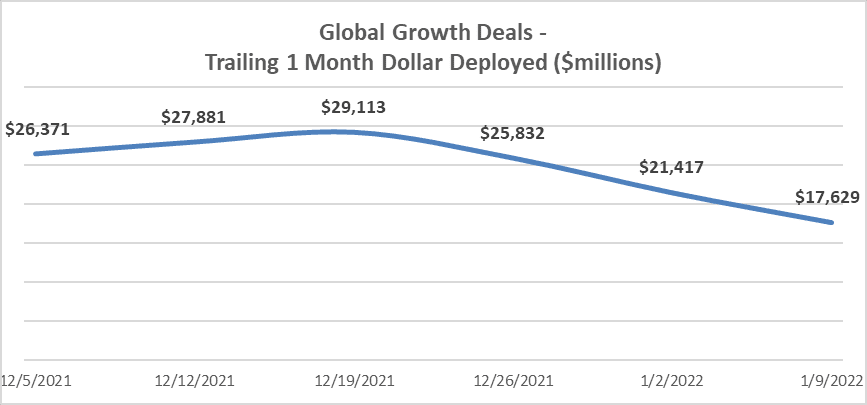

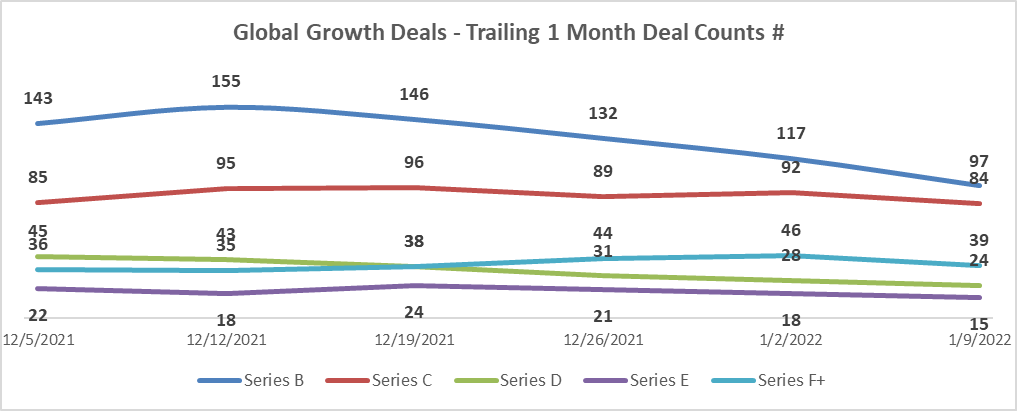

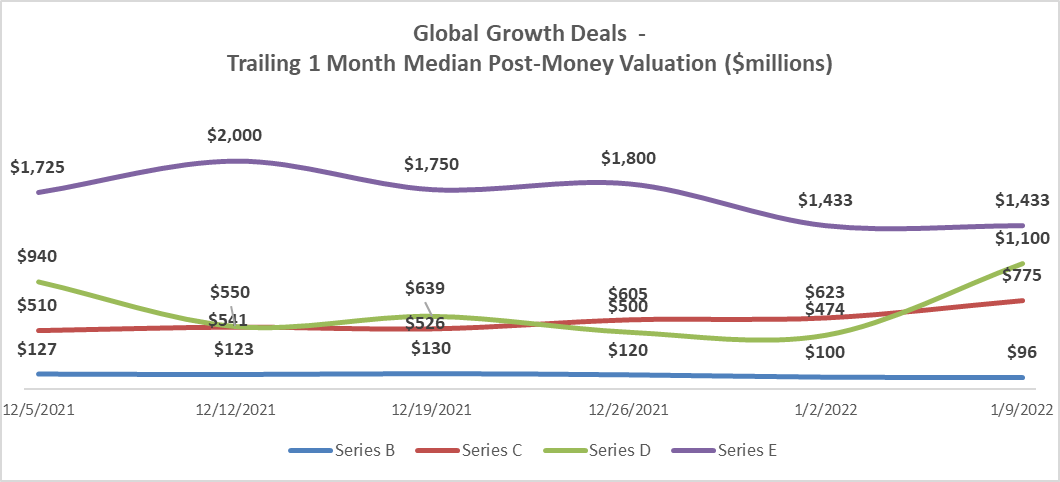

Chart of the Week in Private Market

(Deal data as of 01/09/2022, source: Pitchbook. Defined as - Series B+ global growth stage deals)

$$$ Announcement & Commentary:

Welcome to 2022! Companies in the private market continued the strong fundraising momentum from 2021 and opened the new year with an incredible amount of fresh capital to further support growth roadmap and expansion. Starting from this issue, our publication will track global fundraising activities (Series B+) as well as the valuation trends for all stages of growth. Despite the names of the stage, it’s interesting to observe that valuation converges at Series C and Series D stage. Our guess is that the private market has been rewarding superior growth and strong Go-to-Market (GTM) motion with a premium as soon as companies start to see the scale. Some of the massive fundraising announcements we have been paying attention to are (note: valuation in post-money unless otherwise specified):

Rec Room (Series F, $3.5B): Rec Room wrapped up 2021 strong with a $145M Series F, led by Coatue and with participation from Sequoia, Index, Madrona, and others. The company has seen incredible momentum growing from 2 million people playing & creating content on March, 21 to now over 37 million (source). The rise of Roblox, Rec Room and other social/gaming private companies is signaling strong users' interest in a more open, interactive, socially immersed internet

Miro (Series C, $17.5B): the San Francisco-based visual collaboration online platform opened 2022 with $400 million fresh capital from investors including ICONIQ Growth, Accel, Atlassian, Dragoneer, GIC, Salesforce Ventures, and TCV. As one of the leaders in visual collaboration, the company aims to power teams and companies of all sizes to work more smoothly together

Labelbox (Series D, -): Labelbox announced a $110M series D financing to accelerate the development and distribution of its AI training data platform. Led by Softbank Vision Fund II, the round was joined by investors including Snowpoint Ventures, Databricks Ventures, Andreessen Horowitz, and ARK Invest CEO Catherine Wood

Figment (Series C, $1.4B): the momentum with blockchain infrastructure investments continued into 2022 with Figment’s newly announced $110M Series C. Thomas Bravo led the round with participation from Counterpoint Capital (Morgan Stanley), Binance Labs, ParaFi Capital, and others. The company is anchored on the growing adoption and usage of next-generation Proof of Stake (“POS”) blockchains and the ecosystem around them

OpenSea (Series C, $13.3B): about 6 months after the $1.5B Series B, OpenSea saw a nice step-up with a freshly raised $300M capital at $13.3B post-money valuation. This round is co-led by Coatue and Paradigm with participation from Katie Huan’s new crypto fund. The NFT marketplace had an incredible year with a 2021 trading volume well over $15B+ (source) and new highs in both active traders and registered users

Reddit (IPO Ready, $15B+, Source): ah how time flies - our readers probably still remember when Mr. Keith Gill (aka “RoaringKitty”) testified in front of the House Financial Services Committee almost 1 year ago. The social media platform has recently tapped Wall Street bank Morgan Stanley and Goldman Sachs for its initial public offering run. Reddit has confidentially filed for an IPO in December and is aiming for a valuation of $15B+

Justworks (Fresh off Roadshow, Source): Justworks (JW) disclosed on Jan.4 that it has set terms for IPO target between $29-$32 a share. The new-york-based benefits, payroll, and human resource software company focused on SMBs was previously backed by firms such as Thrive Capital, Bain Capital, Redpoint, and Index Ventures