To stay in touch, you can find us here: GZ's Twitter and Shan’s Twitter

Market Commentary:

1. MDB earnings - “glass half empty.”

In our previous issue, we talked about how MDB and DDOG's earnings delivered similar messages regarding the impact of macro headwinds, but DDOG's earnings were viewed as "de-risk" while MDB's stock price was down 15% AH. This week we thought it would be worthwhile to go over MDB's earnings number in-depth and see what went wrong.

MDB delivered a solid FQ2 result highlighted by Atlas's 73% Y/Y growth. While this seems like a meaningful slowdown from FQ1's 82% Y/Y growth, Q2 also had 10% tougher comps. So we think Atlas's performance is acceptable. However, what scares growth investors the most is the macro challenge. In the earnings transcript, the management notes several areas of slowdowns. Europe experienced a broad-based slowdown in consumption. The initial weakness in Europe in Q1 spread globally in Q2. The magnitude of the slowdown was also greater than anticipated. MDB's self-service channel, which typically serves as the "top of the funnel", also experienced slower than historical consumption growth. The slowdown in mid-size company consumption was also global vs regional in Q1. The new customer add was 1,800, lower than 2,000+ expected. FY23 revenue guidance was raised to $1.196-$1.206B, vs the $1.18 midpoint prior. Guidance was up $19M at mid-point, which is less than the FQ2 upside, which suggests 2H weakness in FY23. With so much impact from macro pressure and 13x NTM P/S multiples, growth investors now see little to no upside in buying.

2. Panda, Panda, Panda (not the song nor the animal, but the Merge)

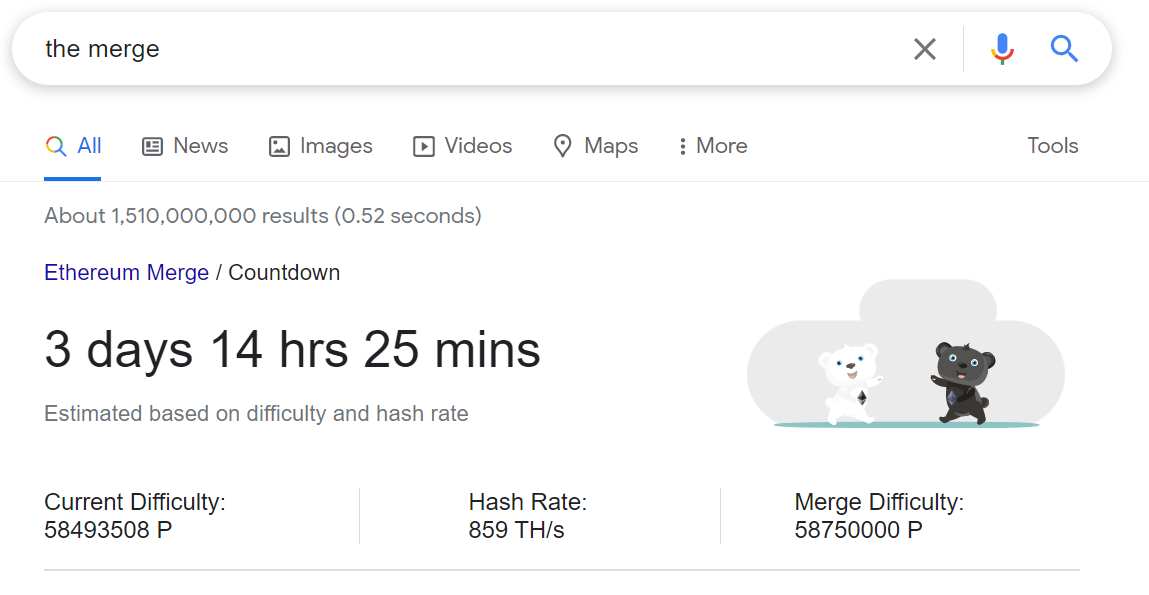

Allow us to be a crypto nerd this week - we are beyond excited about the upcoming Merge on Sep 13-15th. The Panda meme (source & creator right here) is commonly referred to in the blockchain community as an adorable way of depicting the upcoming Merge for Ethereum mainnet. The two lovely bears perform the Dragon Ball Z’s “fusion dance” and merge into a super panda. The execution layer and consensus layer upgrade to transition Ethereum to a complete Proof-of-Stake system. You can search Google right now and get the tracker of the countdown listed above yourself. Now, let’s dive into it:

What is the Merge? To help our readers understand, the two most important concepts to introduce are Proof-of-Work and Proof-of-Stake. PoW is a consensus protocol that allows nodes of the Ethereum network to agree on the state of all information recorded on the ETH blockchain, both for validation purposes and the prevention of certain kinds of economic attacks. The Work here is the action of mining - adding valid blocks to the chain. Miners must go through an intense race of trial and error to find the nonce for a block before adding it to the chain. PoS is a different type of consensus mechanism that validators explicitly stake capital in the form of ether into a smart contract on Ethereum. PoS has many advantages, such as 1) better energy efficiency, lower hardware requirement, less ETH issuance, and less centralization risk from hardware providers. The Merge represents the joining of the existing execution layer (Mainnet as we called it) with its new proof-of-stake consensus layer, the Beacon Chain. There is an excellent animated explanation on Youtube.

Why should I care? To say the conclusion upfront - if the Merge is successful, the process will lower Ethereum’s massive electricity requirements by over 99%. Vitalik and the ETH foundation team have worked on this upgrade for over the past 7+ years. PoW has secured Mainnet since the genesis block - if successful, Ethereum’s reliability and consensus timing can drastically improve while maintaining ETH’s decentralization and stability principles. Mining will no longer be the means of producing valid blocks. As users of the chain - we do not need to do anything but node operators and Dapp developers should follow the foundation’s guide here.

Timeline: Since the creation of the Beacon Chain on Dec.2020, we have been following a series of events driving to this endpoint of Merge. The timeline accelerated recently with:

Ropsten Merge (June 8th): first dress rehearsal - Ropsten testnet merged its PoW execution layer with the Beacon Chain PoS consensus chain - process identical to the mainnet

Goerli Merge (Aug 10th)

Terminal Total Difficulty confirmed (Aug 18th)

Bellatrix Hard Fork (Sep 6th): the last major upgrade before ETH moves from PoW to PoS has been activated.

Paris upgrade (Sep 13-15th): triggered by a specific Total Difficult threshold called the Terminal Total Difficulty (TTD) - 58750000000000000000000. Once the execution layer reaches or exceeds the TTD, the subsequent block will be produced by a Beacon Chain validator - the Merge transition is considered complete once the Beacon Chain finalizes this block

More please?

We recommend “The Hitchhiker’s Guide to Ethereum” from Delphi Research which gives a thorough overview of the chain and process of changes.

Impact on Crypto price - there’s somewhat of a long-anticipated surge during the week of Merge. But a lot of it has just been amped up speculation and anticipation. We are not here for financial advice and would suggest our readers do their own research when it comes to trading needs for the upcoming event.

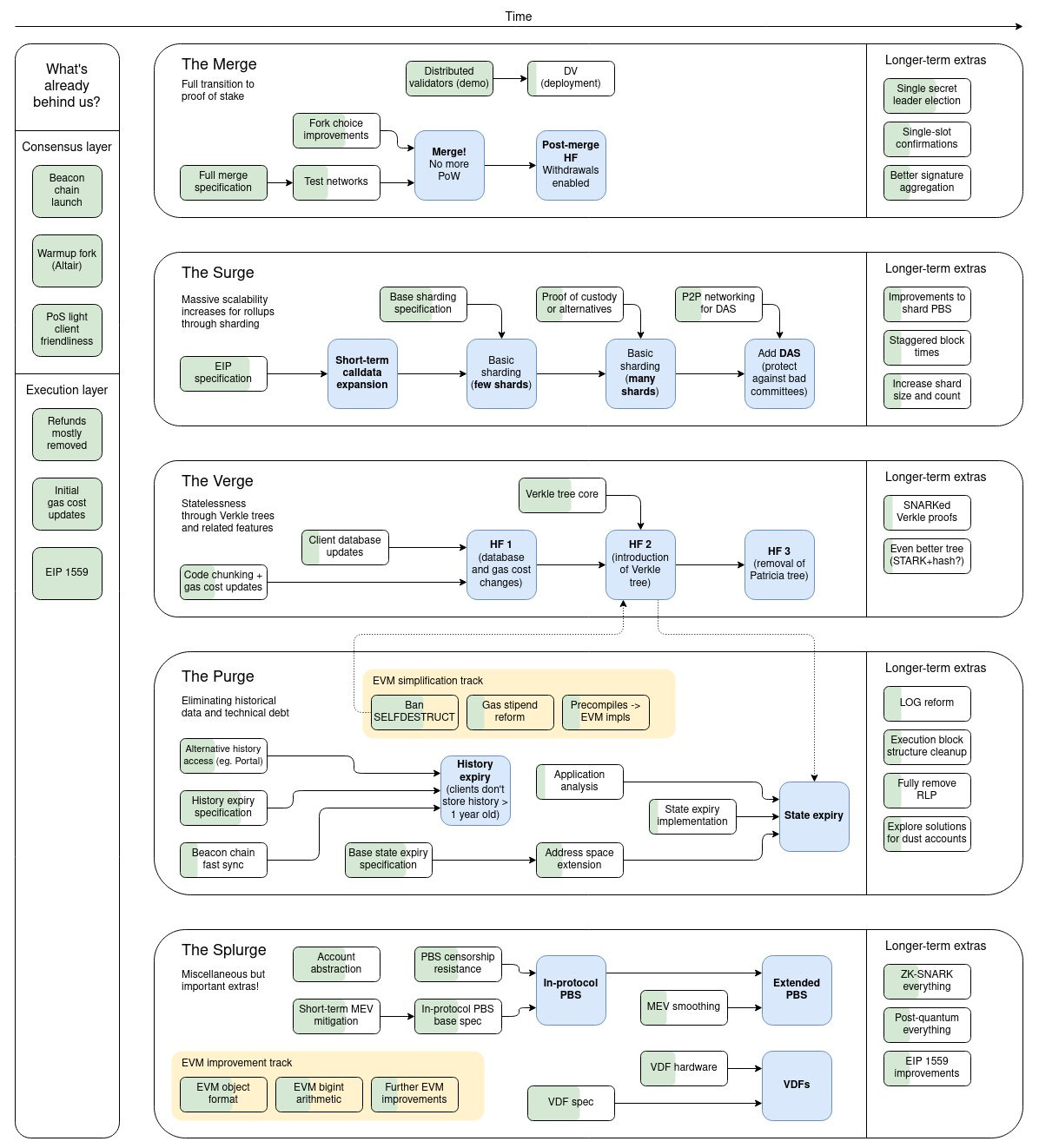

Vitalik’s Endgame Infographic below

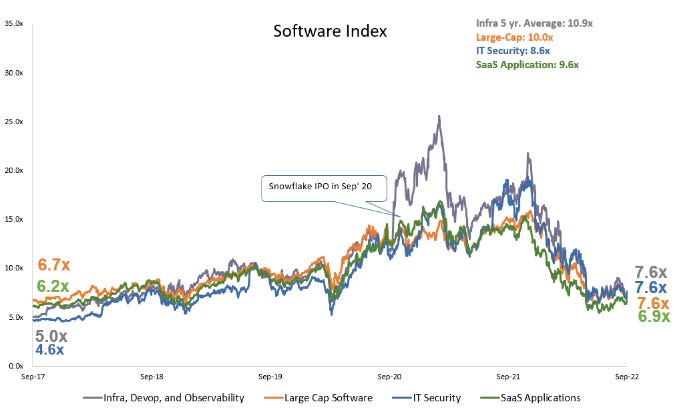

Chart of the Week in the Public Market

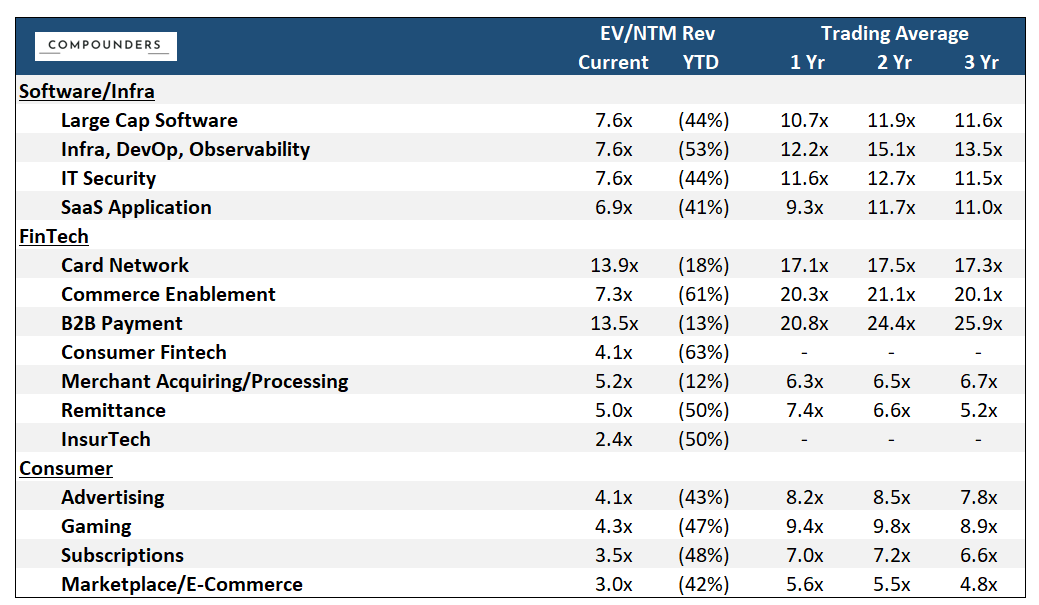

Software rebound from previous low. Infra, large-cap, and IT security traded at 7.6x compared to 7.1x in the previous week. SaaS application experienced a similar level of rebound from 6.0x to 6.9x. We anticipate volatility to continue in the coming weeks.

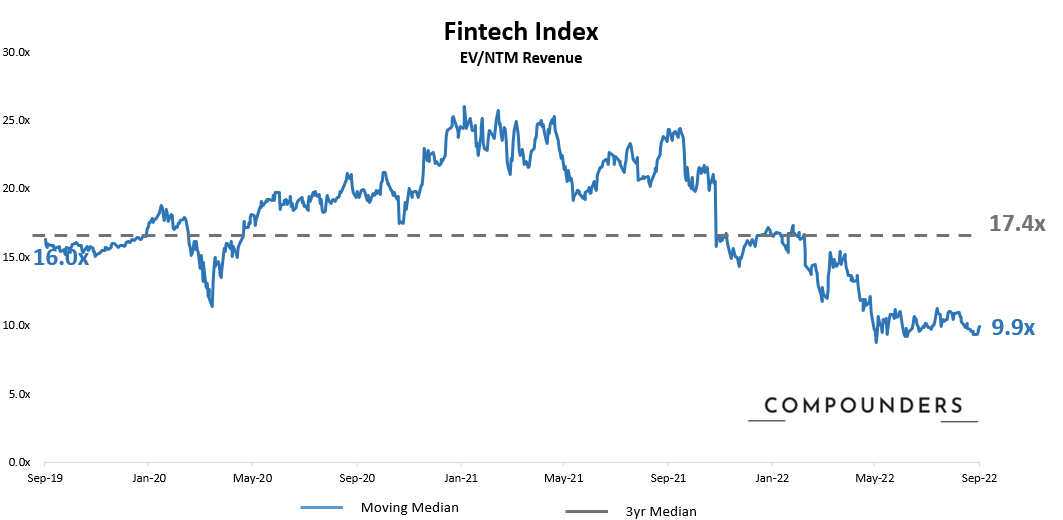

Small rebound in the market last week with the Fintech index trending from 9.4x to 9.9x - the market has been more or less quiet this week with no incremental signal. Two noticeable news came in the format of failed acquisition - UBS acquiring Wealthfront in a $1.4B deal fell through, and Bolt’s $1.5B deal to buy Wyre also terminated last week.

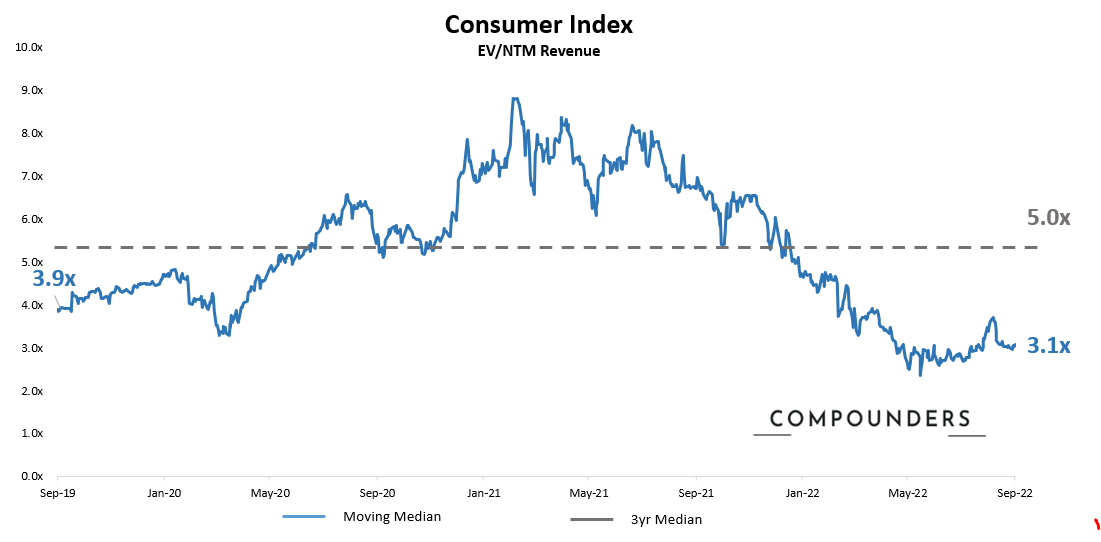

Slight moderation from 3.0x to 3.1x - some smaller retailers are wrapping up the earnings this week. With most Q2 results in the pocket, we are entering the conference season & relatively calm period before the next one.

(Market data as of 9/9/2022, source: Bloomberg, CapIQ. See index composition at the bottom)

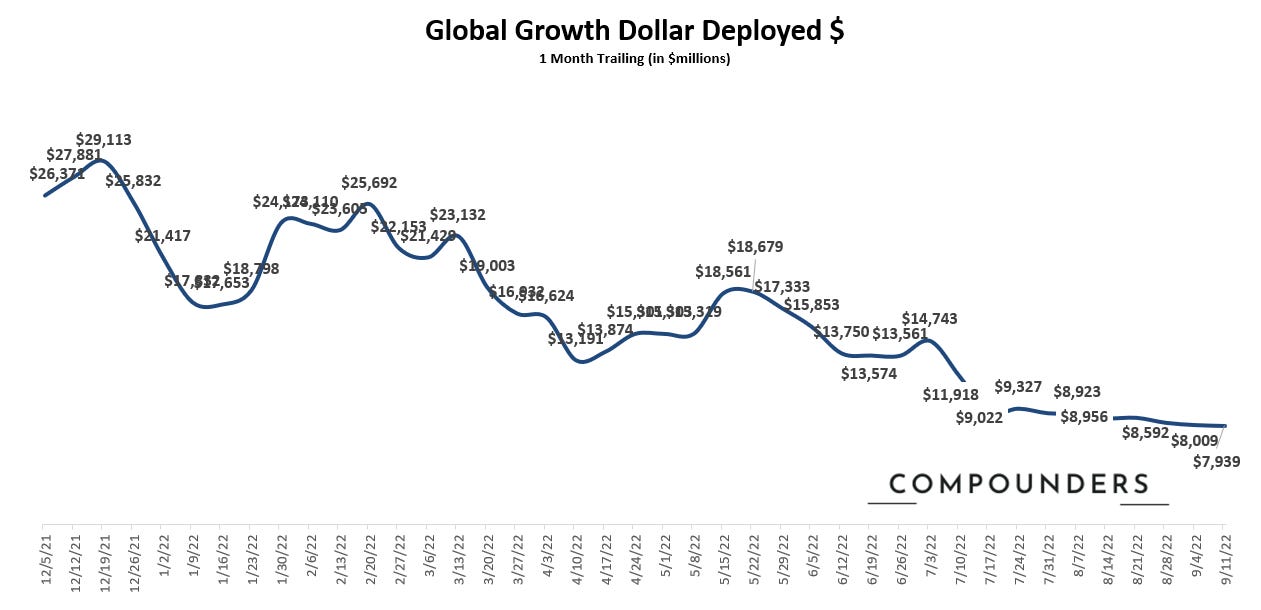

Chart of the Week in Private Market

(Deal data as of 09/13/2022, source: Pitchbook. Defined as - Series B+ global growth stage deals)

Continued low on the private market - most people came back from a long summer after the labor day weekend. Due to the tracker's nature of being slightly behind on real-time dollars deployed, we would need to see into late Sep/early Oct to better understand whether deal activities are picking back up. But we have heard more companies out fundraising and conversations picking back up - we would expect somewhat of an upper climb into the late Q3/Q4 season.

Sources: Software Index: over 200+ public companies / Fintech Index: V, MA, PYPL, SQ, BILL, ADYEN, SHOP, LSPD / Consumer Index: ABNB, BMBL, CHWY, CVNA, DASH, DHER, DKNG, DUOL, ETSY, FB, FTCH, GDRX, GOOGL, MTCH, NFLX, OPEN, PINS, POSH, PTON, ROKU, SFIX, SNAP, SPOT, UBER, W. Please feel free to ping us for further detailed breakdown